INVESTING IN CONTACT FUND

Unlike other community development investing alternatives, Contact Fund notes offer diversification within a single metropolitan area (New York City) and inflation-beating returns.

HOW IT WORKS

Senior Investment notes are offered once per year on April 1 with a term of 12 months with automatic rollover. Our April 2024 notes were issued at 2.75%.Contact Fund is open to accredited individual investors, foundations, and donor advised funds. Minimum investment is $25,000.

Click here for details.

If you're interested in joining the Contact Fund investor community, you can find out more information and request a Private Placement Memorandum at mreed@reedccm.com or (212) 209-3877.

INVESTING APPROACH

"The sum of casual public contact at a local level is a feeling for the public identity of people, a web of public respect and trust, and a resource in time of personal or neighborhood need. The absence of this trust is a disaster to a city street."

-Jane Jacobs

The Death and Life of Great American Cities, 1961

Invest where you live: This ‘place-based’ investing philosophy allows Contact Fund to concentrate capital in under-served neighborhoods throughout New York City.

Leverage a network of high-impact organizations: Established relationships and “on the ground” access to information in community development, finance, academia and progressive philanthropy provide investors with high-quality investment opportunities.

Provide a competitive financial return: Current investors receive a competitive return for a six-month or one-year term.

Bring the voice of the private investor to the table: Connect investors directly to the leaders and funders of high-impact NYC organizations.

Deliver maximum social impact: Provide loans strategically in the capital structure that often make the difference in closing a transaction-- and which can be leveraged by organizations in order to impact a large community of people in the neighborhoods that need it most.

FUND PERFORMANCE

- 47 loans have repaid in full

-

The Fund has co-invested with the following banks and foundations:

- Partners for the Common Good

-

A private philanthropic foundation

| Current Portfolio Statistics (as of 6.30.2024) | |

|

Average Interest Rate |

4.80% |

|

Average Loan Amount |

$318,087 |

GROWTH PLAN

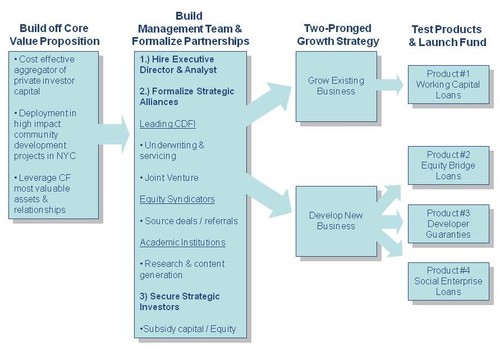

Recognizing that the current credit crisis has created a need for new sources of capital and products in the community investing market, Contact Fund has developed a 10-year business plan to scale its impact. The plan includes:

- Investing in management and internal infrastructure

- Forming partnerships with established community development finance institutions (CDFIs)

- Partnering with strategic investors who share our commitment to high-impact community development

- Leveraging new sources of social capital, as well as equity syndicators

The chart below outlines this growth strategy.

IMPACT INVESTING

Impact Investing - Overview

Over the past few decades an emerging class of investors has developed, growing beyond the traditional philanthropic model, and taking advantage of new opportunities for advancing the social good. While traditional philanthropy has a singular focus on social impact and pure capitalism focuses on profit maximization, Impact Investing uses private market investment strategies to actively place capital in businesses and funds that generate social and environmental good as well as a near-market financial return.

No matter what you call it--social investing, philanthro-investing, impact investing, or mission investing--the sector has experienced a surge of interest among capital providers who want to invest in organizations, businesses, and funds that can solve social problems on a scale that goes beyond pure philanthropy.

Community Development Investing, the segment of Impact Investing that Contact Fund is engaged in is focused on deploying capital in communities that have limited access to traditional financial services. This includes affordable housing, small business development, education and development of community facilities.

The vast majority of Community Development Investing is done by large institutional investors such as governments, pension funds, banks, and large philanthropic foundations. Individual investors are not well represented, but are nonetheless are showing increased interest.

Impact Investing - Motivations and Objectives

Impact investors, by definition, seek investments that provide both a financial and social return. They refute the notion that doing well and doing good must be mutually exclusive. Rather, they blend the desire to do good with the desire to do well.

Contact Fund presents impact investors with opportunities that support their core values:

- Transformational change for those economically distressed as an alternative to the purely philanthropic model

- Capital efficiency, preservation and/or financial returns

- Innovative, cost-effective financing methods that utilize and harness market forces and for-profit capital markets

- An opportunity to take action on matters of social/environmental significance

- A “place-based” investment philosophy that concentrates capital in a particular geographic area

A number of factors are advancing Impact Investing:

- Investor interest in diversification, emerging economies, values-driven consumer behavior, and current and expected regulatory mandates.

- The increased philanthropic engagement by wealthy individuals who are approaching their philanthropy with an entrepreneurial mindset and incorporating philanthropy into their family's financial framework.

- Despite the current recession, individuals are seeking meaning and significance in their lives via impact investing.

- Greater recognition of need for more effective solutions to social/environmental problems.

- New talent interested in careers in social investing and creating a new generation of leadership.

Market Size and Segmentation

It is difficult to estimate current and future capital flow using Impact Investment strategies; however, the Monitor Institute, a leading think tank and incubator for new approaches to social/environmental problems projects a potential $500 billion market in the next decade, or about 1% of total managed assets. This would complement the $300 billion-plus U.S. philanthropic marketplace (with more than 80% donated by individuals).

And when we consider the broader-based approach to investing, Socially Responsible Investing (SRI), the market size increases to an estimated $2.71 trillion of the $25.1 trillion U.S. investment marketplace.

CURRENT PORTFOLIO

BTQ Financial, Inc. provides outsourced financial services to non-profit organizations and is majority owned by three leading non-profits committed to servicing the AIDS community: Housing Works, Harlem United, and Hudson Planning Group. With rapidly growing revenues and more than 60 employees, this vibrant business delivers significant efficiencies to the non-profit community. Contact Fund’s loan to BTQ partially funds an aggressive capital spending program focused on improving scalability by creating remote functionality for clients, codifying client procedures and developing staff training. Contact Fund provided a business line of credit at better terms than conventional lenders, who penalized BTQ for its ownership structure. This loan helped to leverage a loan 5 times the from a private philanthropic foundation.

Fifth Avenue Committee (FAC) is a community-based non-profit founded in 1978. Its formation was sparked by neighborhood demolition to make way for a school that was never constructed. To combat neighborhood blight, FAC was initiated by area residents "to act as conveners and advocates, organizers and sources of technical assistance, and packagers and developers."

With over 100 board, staff, and community members participating in carrying out its plans FAC’s reach in the community is wide. Among workforce development and job placement services, adult education, and advocacy work, FAC has a large housing development arm, developing and maintaining affordable housing for low and moderate-income families in neighborhoods such as Park Slope, Red Hook, Sunset Park, Prospect Heights, Gowanus and Carroll Gardens.

Contact Fund’s $600,000 line of credit targets three different development projects in FAC’s pipeline. The first, Gowanus Green, is a large, sustainable, affordable mixed-use development in Carroll Gardens, Brooklyn, using Contact Fund’s line of credit for critical pre-development costs. The second, Red Hook Homes, a mixed-income cooperative, will be using the funds for the marketing and sales of below market-rate apartments. The third project, Atlantic Terrace, has a significant retail component. FAC used Contact Fund loan proceeds to finance the landlord improvements negotiated in connection with its lease to a national retail tenant.

![]()

Community Homes Housing Development Fund (CHHDFC) is a nonprofit organization, and affiliate of Asian Americans for Equality (AAFE), created in 2000 to increase and improve New York City’s housing stock while promoting and advancing homeownership for minority, immigrant, low- and moderate-income and underserved populations.

In 2010, Community Homes HDFC began a pilot REO program in which it has targeted neighborhoods in Queens which have been most impacted by the foreclosure crisis including Corona, East Elmhurst, Hillcrest, Jamaica and South Ozone Park. Contact Fund's $500,000 loan will provide flexible capital to purchase and rehab foreclosed homes in Round 2 of their REO program.

The New York City Montessori Charter School (NYCMCS) was authorized by the New York State Education Department in December 2010, and opened its doors on September 6, 2011. It’s located in District 7 in the Mott Haven section of the South Bronx at 416 Willis Avenue, but will be expanding to a larger building in September 2012 a few blocks away. The school’s curriculum is based on an alignment of the Montessori approach with the National and New York State Core Curricula and it is the first charter school in New York City to have this Montessori curriculum alignment. The school will attend to children K-5 when it reaches full capacity of 300 students in 5 years. The school day is almost 20% longer than traditional public schools, from 7:45 A.M. to 4:00 P.M., in order to provide students with additional time-on-task and longer sustained work periods.

In March 2012, Contact Fund closed a 3-year, $150,000 working capital loan to help with a down-payment for a new expanded school space and other working capital needs as the school expands enrollment.

Bronx Shepherds Restoration Corporation (BSRC) is a non-profit NYC Affordable Housing Developer located in the South Bronx with a staff of 45 and an annual budget of $9.8M in 2010. Bronx Shepherds represents 42 member churches, of which 95% are minority congregations. In operation since 1979, BRSC provides a number of services that contribute to the restoration of the South Bronx. These services include rehabilitation of existing housing units, participation in the New York State Weatherization Program, management of organization-owned housing units, and construction of new housing developments under the Low Income Housing Tax Credit Program. BSRC currently manages 500 units in 21 buildings, with a portfolio occupancy rate of 95%.

In April 2012, Contact Fund closed a $400,000 pre-development loan to BSRC for Redemption Plaza. Redemption Plaza will be located on a plot already owned by BSRC at 1665 Jerome Avenue in the South Bronx. The development will be comprised of 71 units of affordable housing, 10,000 square feet of space for an expanded BSRC training facility, and 6,000 square feet of retail dedicated to a fresh food business. The residential units are intended for children aging out of foster care who will Section 8 assistance, as well as low-income elderly individuals living with their grandchildren. The proposed building incorporates an array of sustainable and energy efficient design elements.

Local developers and merchants founded Cypress Hills Local Development Corporation (CHLDC) in 1983, after a period of rapid neighborhood change. Their mission is to revitalize the Cypress Hills community through housing preservation, economic development and the positive development of youth and families. They serve 8,000 residents a year from 15 sites. CHLDC develops affordable housing and helps owners and renters retrofit and repair their existing housing; educates and counsels first time homebuyers and organizes tenant associations; assists parents and teens to organize to improve local public schools; and offers recreational, vocational and educational opportunities for youth, adult education, family and college counseling. CHLDC’s subsidiary, the Cypress Hills Childcare Corporation, runs a family day care network, an In-Home Head Start and Day Care Center which they built in 2000. To date, CHLDC has developed 355 affordable housing units, nine commercial units, a child care center and a new public school building.

Contact Fund’s $500,000 loan to CHLDC is for predevelopment expenses associated with the development of 60 units of affordable housing in the Pitkin-Berriman Housing Development, located at 250 Pitkin Avenue, Brooklyn - a site CHLDC acquired in 2011. The proposed 68,725 square foot housing development will have 5 studios, 20 one-bedroom, 25 2-bedroom and ten 3- bedroom apartments, with 12,064 square foot of commercial space on the ground floor targeted to become a grocery store with a hydroponic roof garden to supply fresh produce. The targeted AMI of residents will be 60% and below.

Greater Jamaica Development Corporation (GJDC) was founded in 1967 as a development organization in the Jamaica, Queens neighborhood. It is a community–building organization that plans, promotes, coordinates and advances responsible development to revitalize Jamaica and strengthen the region. The organization’s work expands economic opportunity and improves quality of life for the ethnically and economically diverse residents of Jamaica and for the region, through rational, well-planned and sustainable metropolitan growth. GJDC’s contributions to building a sustainable and prosperous downtown Jamaica include adaptive re-use, business development and business and industrial retention.

Contact Fund’s loan is for construction costs associated with renovating a leasehold space for a tenant, the Federal Department of Probation, with a five-year lease. This loan will be fully amortized over the life of the lease.

Women's Housing and Economic Development Corporation (WHEDco) is a previous borrower to Contact Fund that recently received another loan for a new development. Contact Fund’s current loan is for pre-development costs associated with the development of WHEDco’s Bronx Commons development in the Melrose Commons neighborhood of the Bronx. The proposed 361,600 square foot mixed-use project will include 293 mixed-income rental apartments for persons between 50% and 80% of Area Median Income. Approximately 75% of the units will be 2-bedrooms or more. The project also consists of a grade 6-12 public charter school in partnership with Bard College, the Bronx Music Heritage Center, retail space, open green space and a rooftop hydroponic green house.

STRIVE’s mission is to help people acquire the life-changing skills and attitude needed to overcome challenging circumstances, find sustained employment, and become valuable contributors to their families, their employers, and their communities. STRIVE serves the hardest-to-employ, often individuals leaving the criminal justice system, and over one third between the ages of 18-24. STRIVE’s training program addresses a broad spectrum range of personal attributes, including job skills, interpersonal skills and life planning skills.

After its founding in East Harlem, STRIVE expanded aggressively during the 1990’s, opening affiliates in over a dozen North American cities and four other countries. The economic downturn and the complex operating model destabilized the organization. During 2013 STRIVE board members approached SeaChange Capital Partners to discuss an organizational renaissance, a portion of which relied on a new management team and re-gaining access to credit, having defaulted on prior bank loans. Contact Fund extended revolving credit terms that enabled the organization to bridge typical seasonal cash flows associated with fee-for-service contracts, while upholding a level of fiscal discipline that will be necessary for STRIVE to “graduate” from Contact Fund to traditional bank lending products.

Hale House Center, Inc. was established in 1969 by Mother Clara Hale to serve children and families in need. Its Harlem-based programs offer a safe, nurturing environment and an opportunity for a better future through individualized support and educational services. Current initiatives include a state-of-the-art learning center for children ages six weeks to five years and a supportive transitional housing program for single parent families.

In July 2014, Contact Fund closed a $500,000 working capital line of credit, which pairs Contact Fund capital with strategic repositioning guidance from SeaChange Capital Partners.

Healing Arts Initiative (HAI) is an arts and education nonprofit headquartered in Long Island City, Queens. HAI is a city-wide organization whose mission is to “eliminate barriers to art for New Yorkers shut out of the cultural mainstream”. HAI brings visual arts, music, dance and movement, photography, and media arts into schools, hospitals, prisons and other health and social service settings. HAI also brings low-income and disabled persons out of isolated or monotonous institutions to experience the arts in mainstream cultural venues and local community centers using its fleet of specially adapted buses and trained drivers. Healing Arts reaches over 350,000 people annually with a budget of $5.8m and a staff of 23.

Contact Fund $65,000 loan investment helps support HAI’s Tickets to Go program, an exclusive vendor relationship with the New York City Department of Education (DoE) through which NYC public schools purchase discounted/group rate tickets to Broadway and Off-Broadway shows, AMC movie theaters, and other live performances city-wide.